does indiana have estate or inheritance tax

There is no obligation. Learn Indiana income property and sale tax rates so that you can estimate how much you will pay on your 2021 taxes.

Indiana Estate Tax Everything You Need To Know Smartasset

You can use the advance for anything you need and we take all the risk.

. If your probate case does not pay then you owe us nothing. Your credit history does not matter and there are no hidden fees. Indiana state income tax rate is 323.

This is not a loan as we are paid directly out of the estate and the remainder of your inheritance goes straight to you.

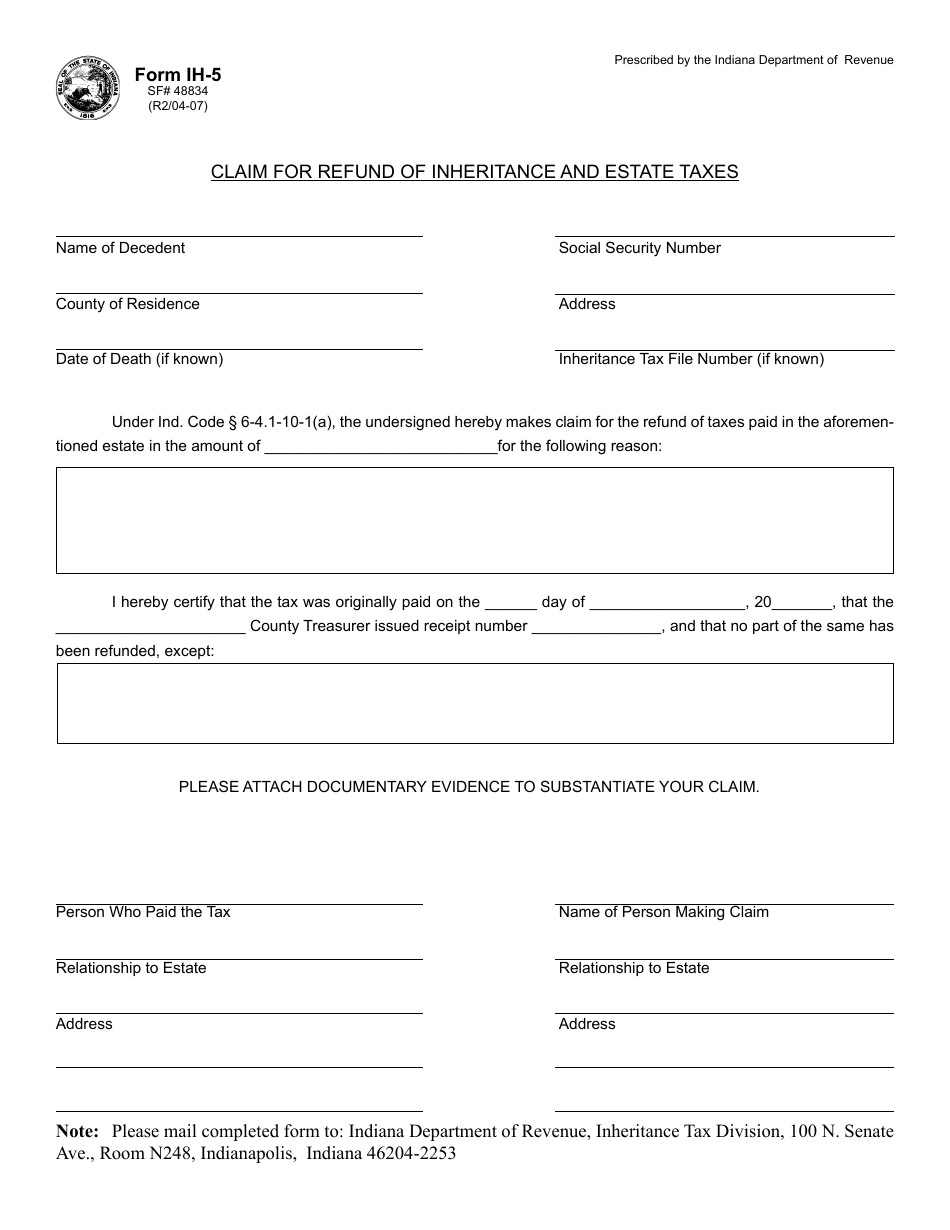

Form Ih 5 Download Fillable Pdf Or Fill Online Claim For Refund Of Inheritance And Estate Taxes Indiana Templateroller

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Indiana Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

State Death Tax Is A Killer The Heritage Foundation

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Pdf Inheritance Tax Regimes A Comparison

Should Indiana Phase Out Inheritance Tax Indianapolis Business Journal

States With An Inheritance Tax Recently Updated For 2020

States With Inheritance Tax Or Estate Tax Bookkeepers Com

Pdf Inheritance Tax Regimes A Comparison

What Are Inheritance Taxes The Complete Guide Taxact

Washington Has The Nation S Highest Estate Tax Most States Have Gotten Rid Of The Tax Opportunity Washington

State Estate And Inheritance Taxes Itep

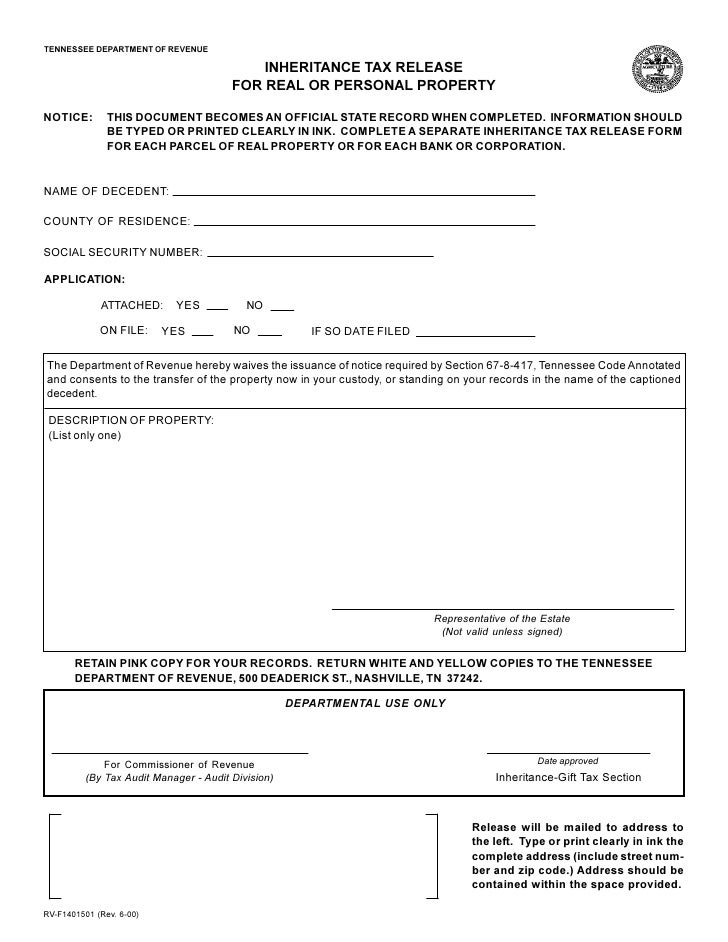

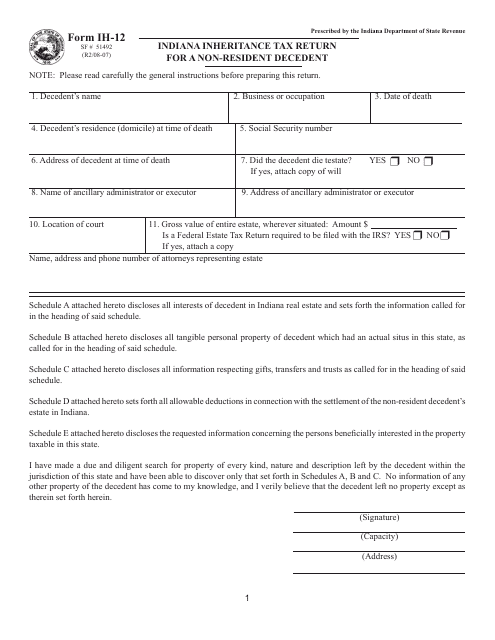

State Form 51492 Ih 12 Download Fillable Pdf Or Fill Online Indiana Inheritance Tax Return For A Non Resident Decedent Indiana Templateroller